Attitudes towards risk shape a broad set of decisions relating to important outcomes such as savings and investments, labour supply, retirement, insurance, health behaviours and lifestyles. So naturally the determinants of risk attitudes and risk preferences have attracted a great deal of attention. The economics literature has shown that richer people display on average a lower degree of risk aversion but also that risk attitudes appear to be influenced also by other factors including personality traits, language structure and education.

But how might risk attitudes evolve over the life-cycle? Although the majority of theoretical models assume that risk preferences are time-invariant, recent empirical literature has shown that risk preferences may vary substantially. Specifically, it has been shown that older individuals are less willing to take financial risks than their younger counterparts, with one potential mechanism being the cognitive decline that happens at older ages. In recent research, we used SHARE data to investigate in more detail the changes in risk attitudes at older ages and how these changes are associated with the broader types of changes and major life events that people experience as they age. Using the SHARE panel to look at within-person changes in attitudes we confirm that risk attitudes do change with age but go on to show that some of these changes are actually due to life-event related shocks, and importantly to health shocks, rather than just age per se.

Understanding the evolution of financial risk attitudes in the latter part of life is also important for policy. With increasing fractions of the population entering older ages, knowledge of the financial risk attitudes of future older cohorts is essential for the successful design of important welfare programs. In areas such as pensions, long-term care and health insurance, coverage for risks specific to older ages is typically based on a mix between public and private schemes (annuity and insurance market). Thus gaining insights on the changes in financial risk attitudes of the elderly supports the implementation of public programs that will effectively interact with private plans and can improve social welfare.

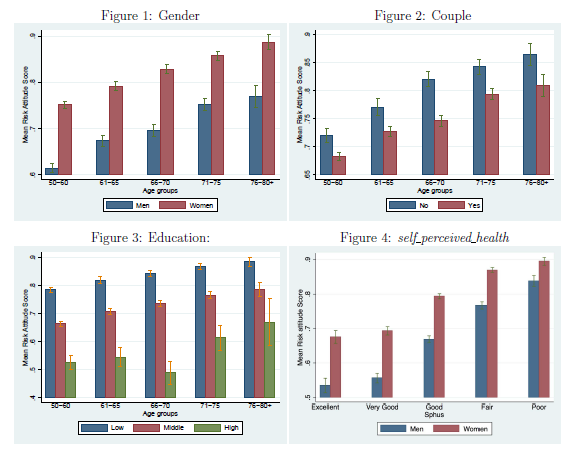

Our study uses SHARE data from wave 2 (2006/2007), wave 4 (2011) and wave 5 (2013), which contain longitudinal measures of self-reported risk attitudes in 14 different countries. Figures 1-4 show how our measure of risk attitudes varies by age and other selected characteristics and show the marked decline in willingness to take risks with age observed in the raw data. There are approximately 25,000 individuals in the SHARE sample who have had two measurements of risk attitudes taken so we to use this sub-sample to estimate econometric models exploiting estimators that rely on within-individual changes to identify the effects of interest. We estimate a panel-data model with random effects that still reveals an important and significant role for age. That is, we show that the change in risk attitude at older ages is not just a cross-sectional phenomenon that may be a result of cohort effects or the fact that people with systematically different risk attitude are more likely to survive longer.

But with our panel data model we can go further. By controlling for increasingly more time-varying factors we investigate the degree to overall raw age pattern may be driven by the kind of life-events that increasingly happen as individuals grow older. Thus our main contribution is to document the role of other life-events such as widowhood, leaving work, drawing a pension, and also particular health-related events. These are shown to be important determinants of changes in risk attitudes within individuals over time and when we add these controls to our models they can, on average, explain roughly half of the age pattern observed in the raw data. With such a large sample, we are also able to consider potentially heterogeneous effect of life-events and age on risk attitudes for different broadly defined groups. Qualitatively, we find that life-events and health changes are important in explaining the evolution of attitudes to financial risk both for the older and younger members of our sample and for men and women. Quantitatively, however, the age patterns in the raw data for those in older ages (65 and over) are less marked than in the younger sub-sample. Additionally, the life events and health changes make a greater contribution to explaining the age pattern for women (of all ages) than they do for men. Finally, exploiting the geographic variation within SHARE, we find systematic differences between clusters of European countries, both in the overall patterns of risk attitudes across geographical groups and also in the way age and life-events affect our risk measure, consistent with the idea that the nature of the welfare state and social protection is a determinant of individuals willingness to take financial risks and the way in which the consequences of life-events and shocks might have knock-on effects on willingness to take risks.

The article is based on:

Banks, J., Bassoli, E., Mammi, I.: Changing attitudes to risk at older ages: The role of health and other life events, Journal of Economic Psychology, Vol. 79, August 2020, DOI: https://doi.org/10.1016/j.joep.2019.102208

About the authors:

James Banks, University of Manchester and Institute for Fiscal Studies, London

Elena Bassoli, Ca’ Foscari University of Venice – Department of Economics

Irene Mammi, Ca’ Foscari University of Venice – Department of Economics

Leave A Comment