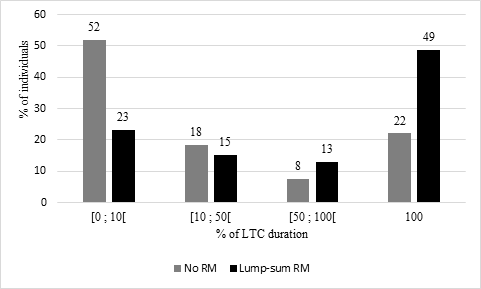

57% of the Europeans aged 65+ will need long‑term care, for 4.4 years on average. Assuming no informal care, nor public insurance, only 6% would be able to pay for care out of their income, 22% by using all their savings except their home, and 49% if they released home equity. A quarter would be able to finance less than 10% of their expenses.

The increase in life expectancy combined with low fertility rates and the ageing of the large cohorts of baby boomers, raise questions about the financial sustainability of long-term care (LTC) systems. These cohorts may have to rely more on their own resources, in addition to public coverage and informal assistance. The paper assesses whether LTC expenses could be privately financed using individual incomes, financial wealth and real estate made “liquid” through reverse mortgages.

Using the first five waves of the Survey of Health, Ageing and Retirement in Europe (SHARE) in nine countries, we build a microsimulation model to simulate the disability trajectories of people aged 65+ in 2013, as a function of their age, sex, income, level of education, country and initial disability status. We assume that care is needed if one has two or more limitations in activities of daily living and take into account the probability of death and of recovery from disability. We estimate the cost of LTC using basic assumptions on the number of hours of help needed (around 28 hours per week) and the hourly labour costs in each country. The disability trajectories are simulated from 2013 to 2051. We then assess the ability to finance LTC needs using information on income and assets from the fifth wave of SHARE.

We find that 57% of the Europeans aged 65+ will experience disability, for an average duration of 4.4 years. The annual cost of LTC ranges from €20,400 in Spain to €42,100 in Denmark, much above the median income in all countries.

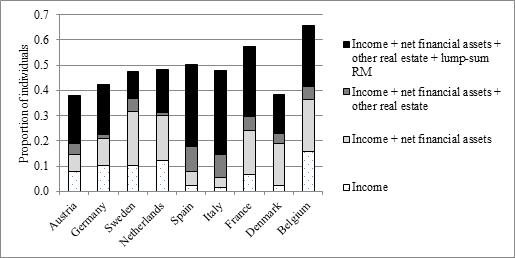

The analysis of the ability to pay for LTC focuses on those who will be without a spouse when needing LTC. They are likely to be more vulnerable, and to receive no informal care. According to our estimates, only 6% of single dependent individuals could finance their LTC expenses from their sole income. This proportion would rise to 22% if they depleted their financial savings and sold their real estate but not their main residence.

We then assume that people take out a reverse mortgage on 100% of their home value at the time they become dependent and receive a lump-sum payment. The mortgage is “reverse” meaning that the borrower does not pay back anything as long as she is alive, but the lender (1) will be paid back at the end of the contract (here at the death of the borrower) and (2) cannot claim more than the value of the home at that time. Besides the value of the home, three parameters are crucial: the interest rate of the reverse mortgage, the growth rate in housing prices, and the borrower’s life expectancy. We set the interest rate at 8%, a rather high figure but consistent with what is observed in the UK and the US markets. We assume the growth rate of housing prices is null, and take the life expectancies from the Human Mortality database. The results are robust to changes in these parameters. To give an example, an owner with a remaining life-expectancy of 7 years and a home worth €200,000 would get a lump-sum capital of €116,649. When adding reverse mortgages, the proportion of elderly able to finance their LTC needs is more than doubled and reaches 49% on average. The role of real estate is potentially important in Southern Europe (where the proportion of people with low income and low financial wealth is high, and where many own their home), but also in Belgium and France (Fig. 1).

However, even using all their resources, a quarter of dependent elderly would not even be able to finance 10% of their expenses (Fig. 2). This results from a higher risk of dependency among the low-income individuals, who are also less likely to be homeowners. The risk of becoming dependent is 63% in the lowest quintile of income and only 49% in the top one. The education gradient is also clear. So are large country differences: the probability of needing LTC ranges from 33% in Sweden to 63% in Italy and 68% in Spain.

A caveat is in order: such country comparisons stem from mechanical microsimulations that start from situations where huge variations in public coverage for LTC between countries have induced different saving behaviours over the whole lifespan. The desire to pass on the family residence to children can also play a role.

The potential contribution of reverse mortgages to the financing of LTC needs is regularly discussed. Our exploratory results show that they can have a large effect, but that still half of the population would be unable to fully cover their expenses. It highlights the importance of public coverage, private insurance or informal family help.

About the authors:

Carole Bonnet, Unité Démographie économique, INED (Institut national d’études démographiques)

Sandrine Juin, Université Paris Est-Créteil, ERUDITE, INED (Institut national d’études démographiques)

Anne Laferrère, CREST (Centre de Recherche en Economie et Statistique) and LEDa LEGOS, Université Paris Dauphine

The article is based on:

Bonnet Carole, Juin Sandrine, Laferrère Anne. Private Financing of Long‑Term Care: Income, Savings and Reverse Mortgages. In: Economie et Statistique / Economics and Statistics, n°507-508, 2019. pp. 5-24; doi: 10.24187/ecostat.2019.507d.1972

Leave A Comment