Using data for Belgium, we show that an extra euro in public pension wealth is associated with a 14-25 cents decline in households’ wealth. Today, in Belgium like in other European countries, pension reforms are heading to a reduction in public pension benefits. If individuals don’t save enough to compensate for this loss, standards of living among the elderly will decrease in next decades.

Pay-as-you-go public pension systems expanded quickly over the last half-century thanks to the arrival of baby-boomers to the labor market. Today, the same generation of baby-boomers is reaching the age of retirement and this is the reason most European countries introduced reforms to keep pension schemes sustainable. Other than encouraging older workers to stay longer in activity, another expected consequence of these reforms is a decreasing path of pension benefits’ generosity in next decades.

One of the main reasons explaining households’ saving behavior is to keep unchanged their standard of living after retirement. How will they react to changing pension generosity? Will they substitute one by one any euro decrease in expected public pension entitlements? If they do not, or only do that partially, the life standard of future generations of pensioners will be lower than that observed among today pensioners.

SHARE collects detailed information on households’ assets and SHARELIFE collects, for the same respondents, retrospective information on their working years, mainly employment and unemployment spells and earnings. Using this information for Belgium, we estimated the present value of individuals’ lifetime income up to the age of retirement and, applying the current detailed Belgian public pension schemes’ rules, we computed an accurate measure of individuals’ cumulated public pension wealth. Then, assuming that households’ wealth, out of public pension wealth, corresponds to a large extent to lifecycle savings, we tested econometrically the effect of these two variables, lifetime income and public pension wealth, using a model derived from the life-cycle theory of capital accumulation.

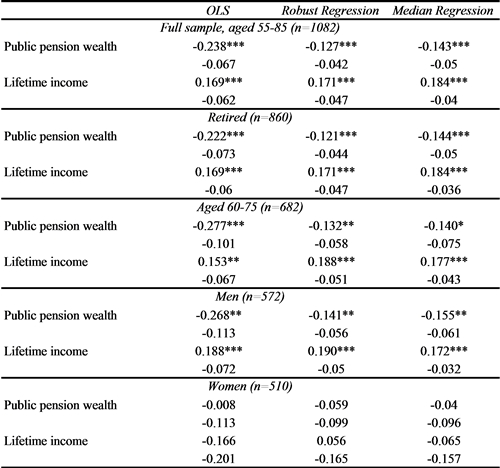

The results we obtain, for the case of Belgium households aged 55 to 85 years old, show that the effect of public pension wealth is far away of the expected one-to-one substitution. We estimate that an extra euro of public pension wealth is associated with about 14-25 cents decline in households’ wealth, rather close to the effect estimated for lifetime income. In Table 1 we summarize the main results of the study. In each case – OLS, robust regression and median regression models – were run using alternative sample definitions. We observe that the results are very stable across different models and sample definitions: full sample, retired, aged 60 to 75 years old, men and women separately. The only exception is among women, in which case the substitution effect, between individual’s public pension wealth and household’s non-pension wealth, is very low and statistically not significant.

Note: Robust standard errors in parentheses. * p < 0.1, ** p < 0.05, *** p < 0.01. Each regression includes age, age squared, marital status, gender, the number of children, education and health as controls.

The implications of these results are important on a methodological ground as they show that it is important to obtain accurate measures of pension wealth and present value of past and future earnings. They are also important for the debate on pension reforms and especially the impact that such reforms might have on individuals’ welfare. Belgium, like other European countries, is in the process of deeply reforming its pension system. The last reforms are heading to an increase of the mandatory age of retirement but also to a reduction of generosity. Our results show that there is a partial substitution effect of public pensions on household’s savings such that people when entitled to pension benefits decrease their savings to a limited amount (14-25 percent). This means that, without changes in their saving behaviors, future pensioners will not be able to keep a standard of living as high as current retired people. In order to avoid this negative impact on individuals’ welfare, reforms which would affect individuals’ pension rights must be announced several years in advance. In this way, people will have the opportunity to adjust wealth accumulation for retirement. Alternatively one can think of incentive programs towards saving that would compensate the loss of future revenue.

About the authors:

Mathieu Lefebvre, BETA, University of Strasbourg, Strasbourg, France

Sergio Perelman, HEC, University of Liège and CREPP, Liege, Belgium

This article is based on:

Mathieu Lefebvre and Sergio Perelman (2019): Public pension wealth and household asset holdings: new evidence from Belgium, Journal of Pension Economics and Finance, doi:/10.1017/S1474747218000409

Leave A Comment